The high growth of FMCG sector has increased the pressures on supply chain. Every company wants to extract the maximum possible output from the current resources – in many cases, driven by a higher demand than supply scenario. Manufacturing units have also come under focus to improve their performance on various parameters like output, service levels, cost, productivity, etc. In such a situation, the management encounters the oft repeated dilemma of which improvement program to pick up – TPM, Lean or Six Sigma (or any other)?

FMCG industry typicality

Manufacturing cost as a share of sales in FMCG companies generally varies from 3-5% vis-à-vis other asset intensive manufacturing companies where it almost double at 8-10%. Selling costs, on the other hand, are much higher in FMCG companies at about 20% of the sales. In a country like India, where the consumer sector and consumer base is in a high growth phase, the companies spend and invest more on selling and supply chain activities. Manufacturing, in FMCG sector, is more like an equal partner in overall supply chain as different to, say, the automobile or engineering industry where manufacturing is the dominant link.

Challenges in FMCG Manufacturing

Manufacturing in the FMCG sector is generally ‘less complex’ and not as ‘asset intensive’ when compared to an engineering company. Also, the activities are not very manpower skill dependent. The manufacturing processes have significant automation or semi-automation in different parts. One of the reasons for this, of course, is to have consistent product quality which supports brand integrity.

In spite of the higher levels of automation, it is quite common to see high manpower at the plants. Most of them would appear to be ‘floating’ and not directly doing anything e.g. on the filling and packaging lines, at many points, operators could be seen just observing the operation.

Most plants produce multiple products and in production processes, batch to batch yield and cycle time variations would be quite common. Multiple products and SKUs also increase complexity of planning process. Demand variations and skews only make matters worse and it is not uncommon to see imbalanced raw material and packaging material quantities and stock outs on the one hand while mismatch of available FG and despatched scheduled stocks, on the other.

To top up the above challenges, there are typical targets of increasing output, improving productivity while reducing manufacturing costs, for the plants.

Expectations from improvement program

Considering the typicality of FMCG sector, the management wants the improvement program to be

- easier to implement

- focussed more on delivering early results

- not high on investment both in terms of capital and resources

What should be implemented?

Since the challenges and targets are spread across manufacturing, managements realize that holistic interventions are more relevant.

It remains, therefore, the recurring question for the senior managements across companies as to which improvement program to implement – Lean, Six Sigma or TPM? And since these initiatives are seen as investments, to implement the one with the maximum returns is but the obvious objective.

None of the above, alone, in most cases, delivers the potential benefits.

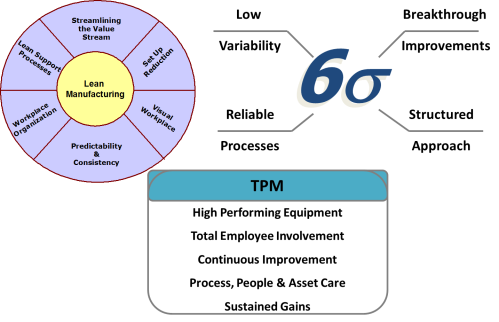

The manufacturing process flow at an FMCG unit can be shown in a simplified way in fivedistinct blocks (without considering the support functions). The challenges in all these parts of the process are quite different and varied. As such, a single program of Lean, Six Sigma, TPM, TQM, etc. may not be able to address the challenges all across. Though they have some overlap in objectives and in the approach to achieve the objectives, they work best when the specific objectives of these initiatives are targeted e.g. to reduce process variability, 6s would be most effective though elements of TPM would be necessary to sustain the improvements.

A combination of tools and techniques from these bodies of knowledge, therefore, works best for FMCG manufacturing. Though this holds true for other industries as well, it is highly relevant for FMCG industry due to the objectives of achieving high improvements from low investments.

Tools of Lean would be more effective in RM/PM/FG storage areas to address issues of high inventories, mis-match of available and required inventories, improving space utilization, improving TAT, etc. In Production processes, Six Sigma approach would yield more benefits in improving process consistency (time and quality), reducing batch costs, etc. while some elements of TPM would be important to ensure high reliability of the equipments (to ensure output) as also control production costs. In Primary and Secondary packaging processes, which are generally more automated, TPM initiatives like Daily Asset Care and Planned Maintenance are more effective in reducing stoppages of the equipments to improve utilization and throughput. Equipment management also helps reduce product and packaging material wastages on the lines.

It would be pertinent to create the appropriate improvement program based on the specific challenges being faced at various stages of manufacturing. While many companies have identified this need and created their own ‘excellence’ programs which are globally implemented, many continue to pick up point initiatives.

In conclusion, the FMCG companies need to structure their excellence journeys in manufacturing, by drawing from the different improvement models, to maximize the achievements and ensure alignment to business objectives.

***